tax per mile rate

The new rate for. Have a question about per diem and your taxes.

Irs Increases Standard Mileage Rate Abdo

For 2022 the standard mileage rate is 585 cents per mile.

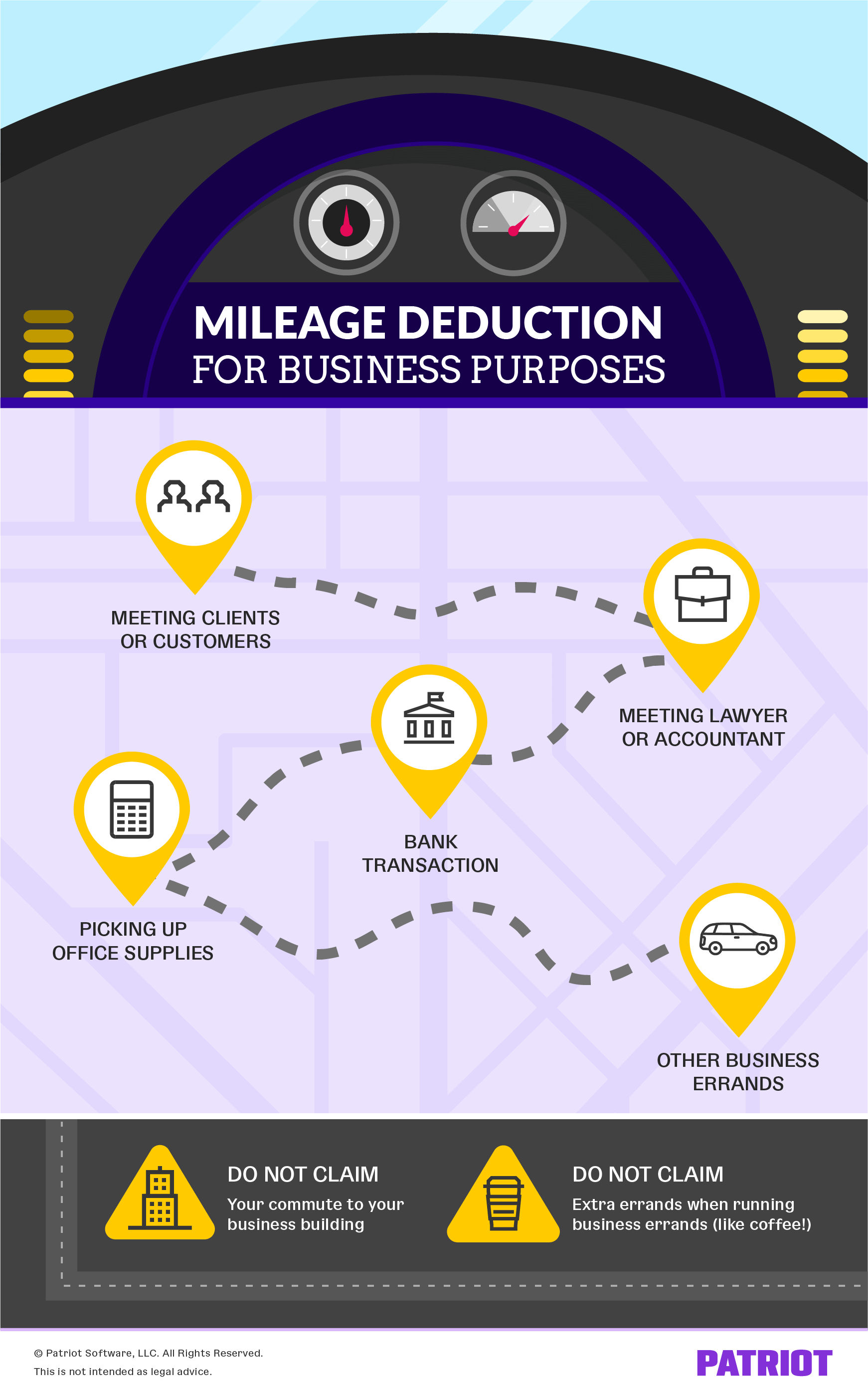

. 585 cents per mile driven for business use. What Mileage is Tax Deductible. Monthly Mileage Tax Report.

Per Diem Rates. The standard mileage rates were 575 cents for business automobiles 17 cents for medical purposes and 14 cents per mile for charitable activities. Flat Monthly Fees Rate Table form 9927-2020.

45p per mile is the tax-free approved mileage allowance for the first 10000 miles in the financial year its 25p per mile thereafter. 56 cents per mile driven for business use down 15. Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020.

Rates are set by fiscal year effective October 1 each year. What Mileage is Tax Deductible. You can use the cents-per-mile rule if either of the following requirements is met.

Uses a rate that takes all your vehicle running expenses including registration fuel servicing and insurance and depreciation into account. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the.

625 cents per mile for business purposes. 78 cents per kilometre for 202223. 45p 40p before 2011 to 2012 25p.

Reefer rates are averaging 319 per mile with the lowest rates. Average Tax Rate per Mile. You reasonably expect the vehicle to be regularly.

Also contained in the notice. A standard mileage rate is the dollar amount per mile imposed by the Internal Revenue Service IRS when calculating the deductible costs for business use of automobiles. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

Rates Rates are reviewed regularly. 22 cents per mile for medical and moving purposes. 2021 rate cents per mile 2020 rate cents per mileBusiness 56 575Medical or Moving16 17Charitable pu.

Passenger payments cars and vans 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and 14 cents per mile driven in service of charitable organizations. Current Weight-Mile Tax Tables A and B form 9928-2022 Effective Jan.

Users are expressing concerns about the cost of driving and incorrectly stating that it would cost drivers 8 cents a mile per a USA Today story. First 10000 miles Above 10000 miles. 1 2022 Prior Weight-Mile Tax Tables A and B form 9928-2020 Effective Jan.

Van rates are at 276 per mile. IRS Standard Mileage Rates from July 1 2022 to December 31 2022. Please contact the Internal Revenue Service at 800.

The standard mileage rates are. The standard mileage rate for business is based on an annual study of the. In reality the vehicle mileage tax.

Reefer rates are 319 per mile. If a business chooses to pay employees an. Per IRS Beginning on January 1 2022 the standard mileage rates for the use of a AutoCar also vans and pickups will be.

As well as the 575 cents for business miles. For the current tax year you can claim the standard mileage rate of 575 cents for every business mile driven. To answer your question on what is the going rate per mile for trucking current trucking rates per mile 2022 averages are.

What Are The Irs Mileage Rate Amounts Updated For 2022

Irs Raises Standard Mileage Rate For 2022

Emerging Tax Regulations Alert Business Mileage Rate Increase

Irs Standard Mileage Rates For 2022 Nerdwallet

Business Mileage Deduction 101 How To Calculate For Taxes

Orego Helps Preserve And Improve Oregon Roads Myorego

How To Calculate Personal Use Of Employer Vehicle Rkl Llp

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

Irs Mileage Rate Explained Triplog

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates

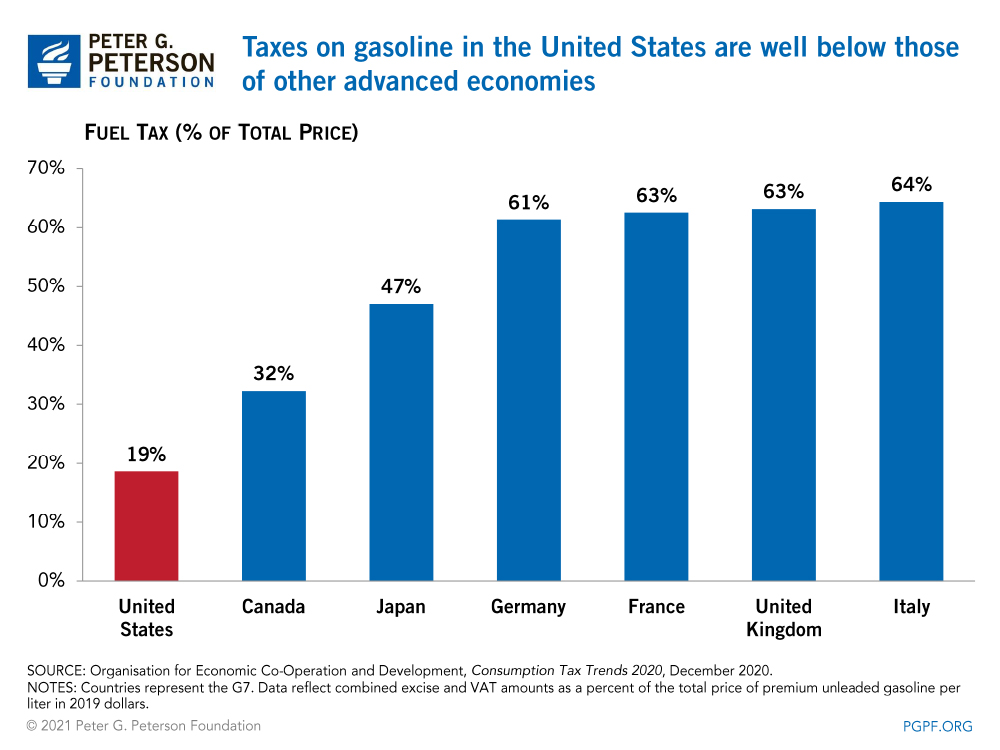

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

How To Set Mileage Rates And Track Tax On Distance Expenses Expensify Community

Mid Year Irs Updates Mileage Rates Tax Return Backlog The 2022 Dirty Dozen

How To Log Miles For Taxes Step By Step Mileagewise

Irs Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices

The Irs Increased The Mileage Rate For The Rest Of 2022 Ketel Thorstenson Llp

Impact Of Mileage Rates And Gas Prices On Tax Deductions Pierce Firm Pllc

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service